The reserve calculation should be based on the taxpayers past history of bad debts industry experience general and local economic conditions etc. Total monthly remuneration RM 500000.

Your Step By Step Correct Guide To Calculating Overtime Pay

Limited to 50 of their cost.

. Malaysia I Malaysian Employment Act 1955 scope of coverage expansion and amendments postponed to 1 January 2023 Sep 1 2022. 21 Calculation of Overtime Work. Net PCB RM 500000 x 28.

Every 5 consecutive hours followed by a rest period not less than 30 minutes. Just click on. The Minimum Wages Order 2020 that has went into effect on 1 February 2020 sets a minimum wage rates in Malaysia.

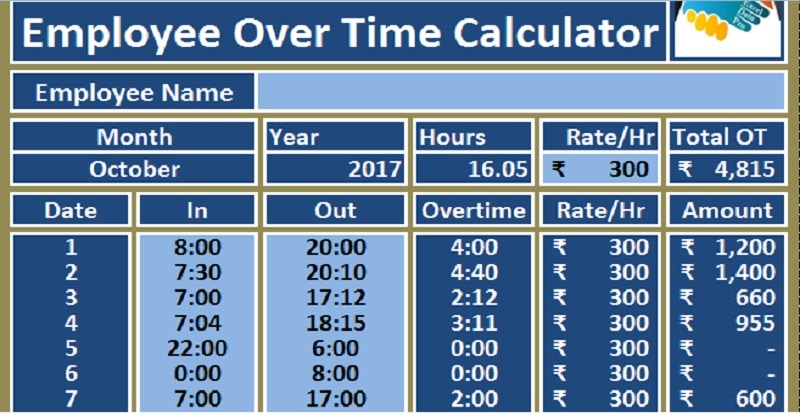

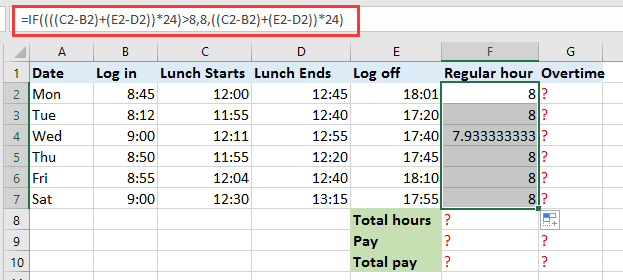

Another common mistake made when inputting information into the payroll check template is the incorrect calculation of overtime hours. If an employee works overtime make sure to pay them the correct amount as stated in your overtime policy. The Order has increased the minimum monthly wage rate to RM120000 in major cities in Malaysia and RM110000 for other parts of the country.

For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary. Leave encashment formula Earned leave encashment calculation formula as per factories act Basic DA26 No of encashment days 26 means working days of the month. GreatDay HR provides a single streamlined automated solution that helps you easily manage all aspects of the employee lifecycle from payroll and tax calculations to attendance records leave requests and reimbursements.

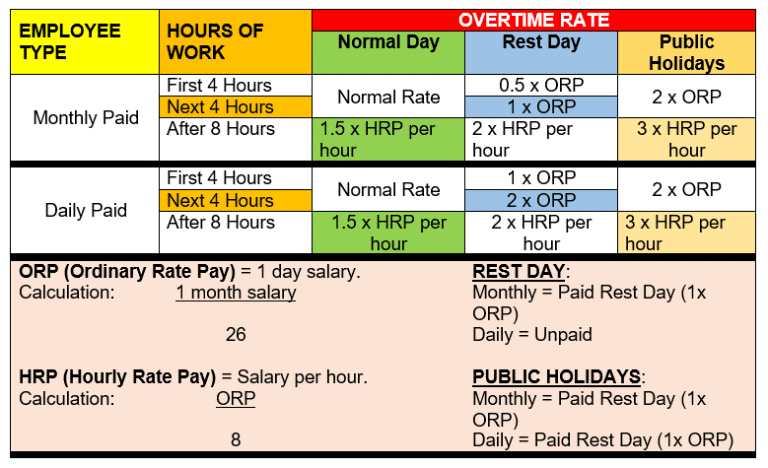

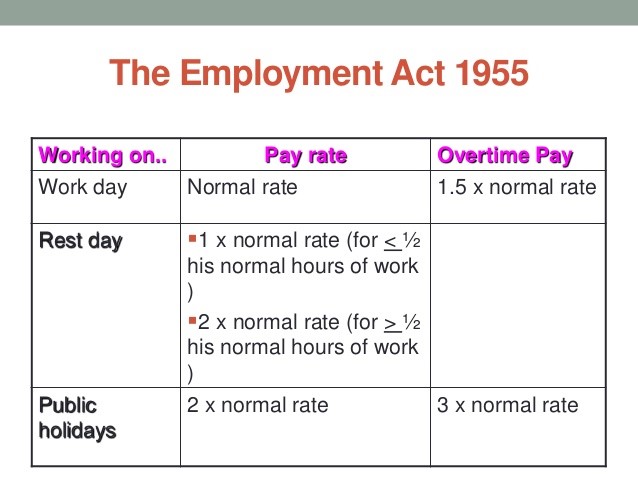

1 Normal Remuneration Normal remuneration is a fixed monthly salary. The work wages is 100 the overtime wages is 150 and the different overtime wages is 200. If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

Simple Free payroll software with full Malaysia Government Statutory Calculations for EPF SOCSO EIS PCB and Bonus with Excel File Export. Employees whose service was after 1 January 2008 a one months salary for every year of service for services more than six months Services with a duration of six months to one year will be considered one year and 2 half. Note on wages calculation.

Normal working hours 1. In Malaysia matters concerning working hours and wages are regulated under the Employment Act 1955 and Minimum Wages Order 2016. PART II THE BOARD AND THE INVESTMENT PANEL.

Any hours exceeding normal working hours is paid at. 7 Add opening balances. Control Your Companys Expenses Efficiently.

Calculation Date and Name. Level 23 Nu Tower 2 KL Sentral Jalan Tun Sambanthan Kuala Lumpur 50470 Indonesia. When a new employee is added a default tax code is added.

This is applicable for employee overtime pay in Malaysia regardless of the salary being calculated by daily rate or monthly basis. Users can further customise the computation for allowance overtime and shift calculation with a built-in formula builder. 6 months salary slips and bank statement are required if you want to include variable income such as overtime commissions etc in addition to fixed salary.

This best payroll software in Malaysia can handle multiple company transactions at a time. Aside from monthly salaries employers in Malaysia need to contribute to EPF SOCSO and EIS of their employees according to the regulations. The contribution amount that apply to employees with salaries exceeding RM4000 per month is stated in the Third Schedule Act 4.

A resident employees PCB calculation are categorised into four formulas. Establishment of the Board. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia.

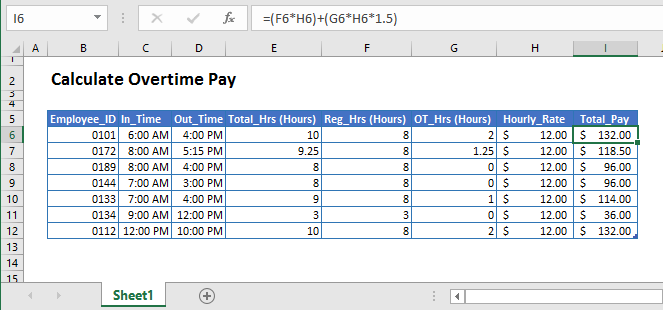

On any normal working days the company should pay employee overtime at a rate of 15 times the hourly rate. Calculation of overtime on Public holiday PH which is recognised by employer. Gratuity payment to employee payable at the end of a service period or upon voluntary resignation.

Effective 1st September 2022 PERKESO will enforce a new wage ceiling for contributions from RM4000 to RM5000 per month. Employees whose service was before 1 January 2008 the calculation is based on the existing laws prior to 2008. Certified true copy of Form 24 Shares issued and authorised share capital.

Salary calculation also differs based on the labor law of a country. Labor laws are distinctive between one country to another. A Better Way of Overtime Calculation.

SQL Payroll Software ready with all HR management eLeave PCB tax calculator specific contribution assignment and automatic overtime calculation. Add opening balances for employees if you switch to Xero payroll part way. Latest version with Overtime Total field and 9 EPF.

For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. Calculation for Employee Overtime Pay in Malaysia Working Days. Overtime on Public Holidays.

In addition to the PH pay employees get OT of 2 times the ORP for one day. You have the option to determine the value in the work wages. SQL Payroll is the only software that you would ever need to use for your Payroll.

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. This includes meals while travelling or attending a seminar conference or convention. Thamrin Boulevard Jakarta 10230.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Having different types of payment modes for your employees is not a problem as it can calculate hourly daily and monthly salaries. Special rules apply for determining reserves for financial institutions.

Therefore be aware of the overtime workers are doing and make sure youre aware of. Overtime payments including payments for work carried out on rest days and public holidays. The tax code and tax calculation method in the employees record must be correct for the PAYE to be calculated accurately.

Calculation of EL on the basis on the salary eligible for the EL Basic DA HRA salary eligible for the EL Basic DA HRA 26 no. Pusat Bisnis Thamrin City Lt. SQL Payroll Software removes the complexities in Human Resources Management make your payroll process easier.

Certified true copy of the Memorandum and Articles of Association. Since 2020 the default. Can include IC and other information to submit statutory documents.

All-in-One HRIS Software to Manage Every HR Task. In each day type. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000.

Only the overtime hours will be included in the pay run. Enter and save staff information.

Your Step By Step Correct Guide To Calculating Overtime Pay

How To Calculate Overtime Pay For Employees In Malaysia Althr Blog

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

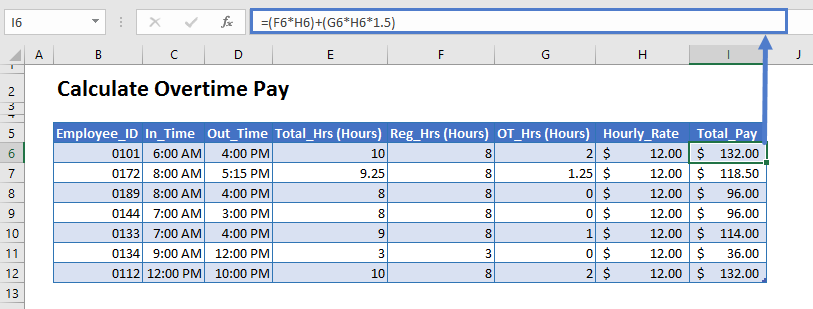

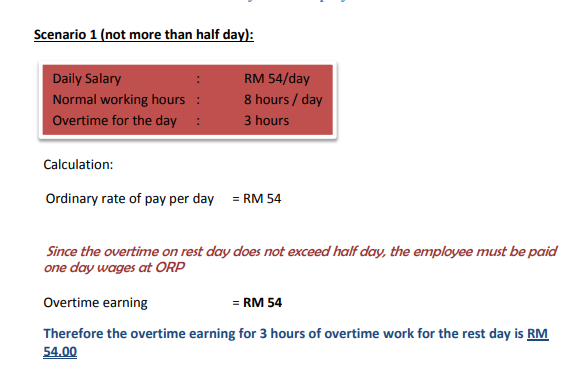

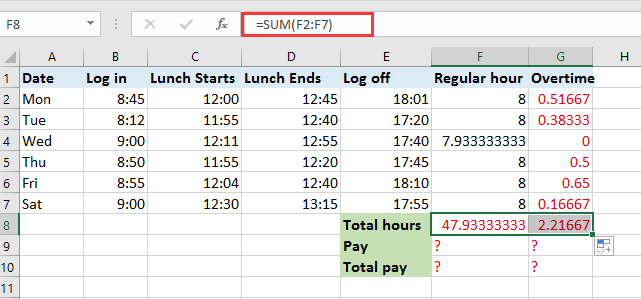

How To Quickly Calculate The Overtime And Payment In Excel

Download Employee Overtime Calculator Excel Template Exceldatapro

How To Quickly Calculate The Overtime And Payment In Excel

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Excel Formula Timesheet Overtime Calculation Formula Exceljet

Calculate Overtime In Excel Google Sheets Automate Excel

Calculate Overtime In Excel Google Sheets Automate Excel

Guide Singapore Overtime Pay Rules And Overtime Pay Calculator

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Basic Overtime Calculation Formula

Your Step By Step Correct Guide To Calculating Overtime Pay

Your Step By Step Correct Guide To Calculating Overtime Pay

Overtime Calculator For Payroll Malaysia Smart Touch Technology

Overtime Calculation Formula In Excel Youtube

How To Quickly Calculate The Overtime And Payment In Excel